Generally, to be entitled to a construction lien or a payment bond claim in Florida, the claimant must provide a permanent benefit to the real property. Although what constitutes a permanent benefit is not specifically defined in the Florida Statutes, guidance can be obtained from court decisions and the statutory definitions of “improve” and “improvement”.

For instance, one court held that maintenance/landscaping services consisting of mowing a lawn and cutting shrubbery did not bestow a permanent benefit. The landscaper was not entitled to a construction lien. Another court ruled that installing plants qualified as an improvement permitting a construction lien. With regard the furnishing of carpet and rugs, the statutory definition of improve was amended in 1975 to include the furnishing of carpet or rugs permanently affixed to real property. Prior to the 1975 amendment, a court held that wall-to-wall carpet in an apartment building was not a permanent benefit sufficient to support a construction lien by the carpet supplier.

So, how does Florida law define “improve” and “improvement”?

“Improve” means build, erect, place, make, alter, remove, repair, or demolish any improvement over, upon, connected with, or beneath the surface of real property, or excavate any land, or furnish materials for any of these purposes, or perform any labor or services upon the improvements, including the furnishing of carpet or rugs or appliances that are permanently affixed to the real property and final construction cleanup to prepare a structure for occupancy; or perform any labor or services or furnish any materials in grading, seeding, sodding, or planting for landscaping purposes, including the furnishing of trees, shrubs, bushes, or plants that are planted on the real property, or in equipping any improvement with fixtures or permanent apparatus or provide any solid-waste collection or disposal on the site of the improvement.

“Improvement” means any building, structure, construction, demolition, excavation, solid-waste removal, landscaping, or any part thereof existing, built, erected, placed, made, or done on land or other real property for its permanent benefit.

Some exceptions exist to the permanent benefit requirement on the real property. Under certain circumstances, a claimant can claim a construction lien on an owner’s real property for work done on publicly-owned government property. By way of illustration, a new subdivision was constructed and was required to provide a turn lane and underground utilities on the municipality’s property (publicly owned government property). Although the labor and materials were provided on the municipality’s property, the lienor is still entitled to a construction lien on the private subdivision property that benefitted from the improvement. Other exceptions, including specially fabricated materials, waste and rental equipment, will be discussed in subsequent posts.

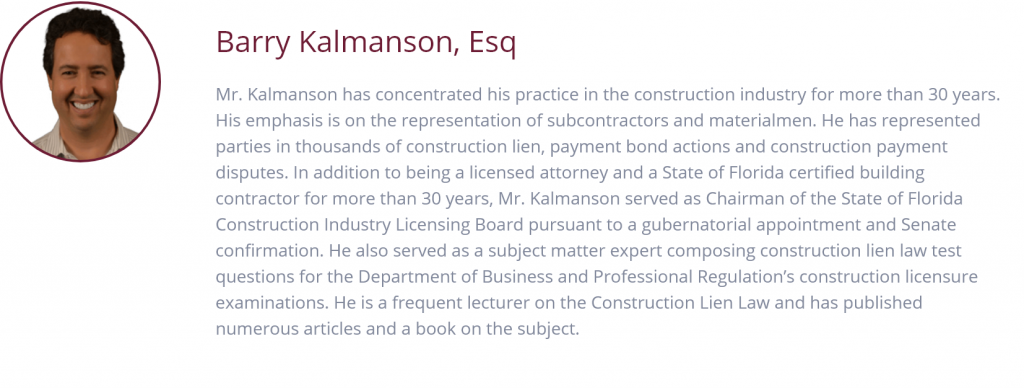

This information presents the general scheme of Florida’s Construction Lien Law as of May 2020. The Construction Lien Law is constantly being amended; therefore, this material should not be relied upon in place of experienced legal advice in specific situations. This material is copyrighted and cannot be reproduced without written permission from Barry Kalmanson, Esq.