On June 21, 2021, Governor DeSantis signed Senate Bill 378 that increases the interest rate relating to payments due for construction services. These changes took effect July 1, 2021. Senate Bill 378 revises Florida’s prompt payment laws. The prompt payment laws provide deadlines for payments to contractors, subcontractors and material suppliers and penalties for late payments. This post discusses public projects and the statutory revisions relating to subcontractors, sub-subcontractors and material suppliers. Private projects will be discussed in an upcoming post.

State of Florida Projects – Section 255.073, Florida Statutes, governs purchases of construction services by any public entity, which is defined as the state, or any office, board, bureau, commission, department, branch division or institution thereof excluding local governments. Local governments are covered by section 218.735, Florida Statutes (discussed later in this post). The statute requires:

- Timely payment by contractors to subcontractors and suppliers (the time period is within 10 days of the contractor’s receipt of payment from the public entity); and

- Timely payment by subcontractors to sub-subcontractors and suppliers (the time period is within 7 days of the subcontractor’s receipt of payment from the contractor).

All payments due for construction services that are not timely made bear interest at the rate of 2% per month/24% per annum until paid.

Local Government Projects – Section 218.735, Florida Statutes, governs purchases of construction services by any local government entity, which is defined as a county or municipal government, school board, school district, authority, special taxing district, other political subdivision or any office, board, bureau, commission, department, branch, division, or institution thereof. The statute requires:

- Timely payment by contractors to subcontractors and suppliers (the time period is within 10 days of the contractor’s receipt of payment from the public entity); and

- Timely payment by subcontractors to sub-subcontractors and suppliers (the time period is within 7 days of the subcontractor’s receipt of payment from the contractor).

All payments due for construction services that are not timely made bear interest at the rate of 2% per month/24% per annum until paid (previously, the interest rate was 1% per month/12% per annum).

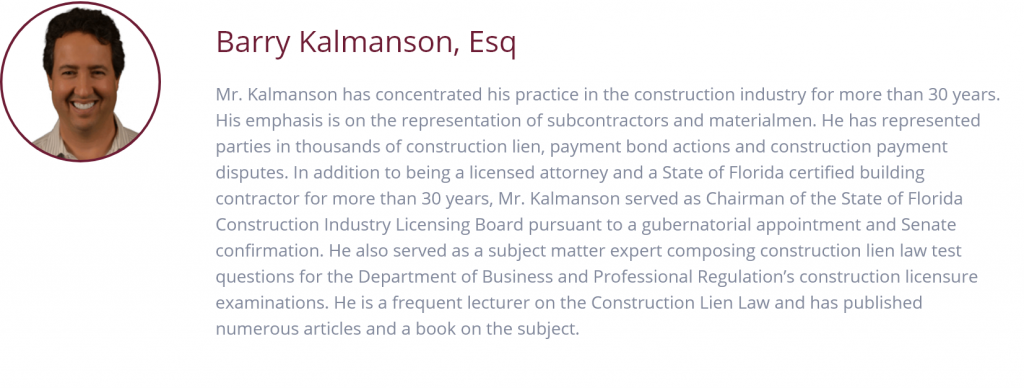

This information presents the general scheme of Florida’s Construction Lien Law as of July 2021. The Construction Lien Law is constantly being amended; therefore, this material should not be relied upon in place of experienced legal advice in specific situations. This material is copyrighted and cannot be reproduced without written permission from Barry Kalmanson, Esq.